PAG Felicitates Muslims on Commencement of Ramadan Fast

February 18, 2026TOP TEN MUSLIM UNIVERSITIES IN AFRICA

February 14, 2026ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

February 10, 2026Fresh Recapitalisation: Bank CEOs, Others In Merger, Acquisition Talks

Fresh Recapitalisation: Bank CEOs, Others In Merger, Acquisition Talks

Indications emerged on Saturday that the chief executive officers and other top executives of Deposit Money Banks had begun moves to raise fresh capital to bolster their respective institutions’ capital base in line with the pronouncement of the Governor of the Central Bank of Nigeria, Dr Olayemi Cardoso.

INTEGRITY NEWS gathered from top sources in the banking industry that the top executives might have also commenced preliminary merger and acquisition talks, as some of the big banks are eyeing some weaker ones for possible acquisition, while some middle strength and weak ones are looking for alliances that may result in mergers.

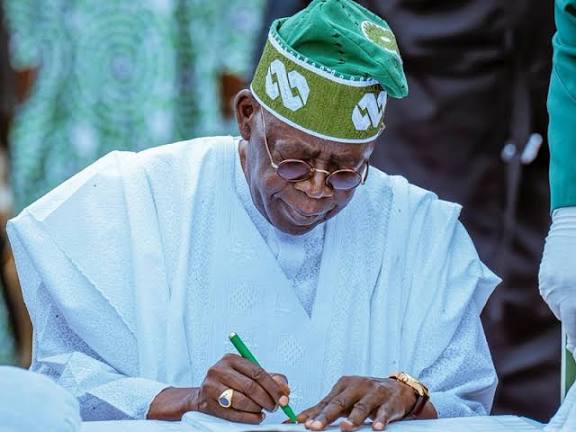

Cardoso had said in Lagos on Friday that the apex bank would be asking the DMBs to increase their capital base in order to service the $1tn economy projected by President Bola Tinubu.

Speaking at the 58th Annual Dinner of the Chartered Institute of Bankers of Nigeria where he was the special guest of honour, Cardoso said, “In my recent speech at the 370th Bankers’ Committee meeting, I highlighted the economic agenda of the President. The administration has set an ambitious goal of achieving a GDP of $1tn over the next seven years.

“Attaining this target necessitates sustainable and inclusive economic growth at a significantly higher pace than current levels. It is crucial to evaluate the adequacy of our banking industry to serve the envisioned larger economy.

“It is not just about its current stability. We need to ask ourselves, can Nigerian banks have sufficient capital relative to the finance system needs in servicing a $1tn economy in the near future, in my opinion, the answer is no, unless we take action. As a first test, the central bank will be directing banks to increase their capital.

“Therefore, we must make difficult decisions regarding capital adequacy. As the first step, the CBN will be directing banks to increase their capital.”

He added, “The removal of petrol subsidy and the adoption of a floating exchange rate and other government policies are anticipated to have a positive effect on the economy in the medium term.

“These measures are expected to enhance investors’ confidence, attract capital inflow, stimulate domestic investors and ultimately improve the level of external reserves. Additionally, they are expected to contribute to the stability of the local economy.

“Despite the challenging global and local economic environment, Nigeria’s financial sector has demonstrated resilience in 2023 with key indications of financial soundness largely meeting regulatory benchmarks.

“Stress test conducted on the banking industry also indicates its strength under mild to moderate scenario on sustained economic and financial stress. Although there is room for further strengthening and enhancing resilience to shocks. Therefore, there is still much to be done in fortifying the industry for future challenges.”

A bank CEO, who spoke to Sunday PUNCH, welcomed the CBN policy direction regarding the recapitalisation of the banks and said his institution was ready to raise fresh capital though it had yet to conclude the modality.

“Even before the CBN governor made the pronouncement, our bank was already considering raising fresh capital to significantly increase the capital base. This should happen in the first quarter of 2024. So, we are in tune with the CBN governor,” the CEO of a Tier-1 lender told one of our correspondents on Saturday.

In the last few months, First Bank of Nigeria Holdings, Wema Bank and Jaiz Bank have proposed Rights Issues, while Fidelity Bank announced plans to raise additional capital via the issuance of 13,200 billion ordinary shares via public offer and rights issue.

END.