PAG Felicitates Muslims on Commencement of Ramadan Fast

February 18, 2026TOP TEN MUSLIM UNIVERSITIES IN AFRICA

February 14, 2026ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

February 10, 2026Economic Reforms: Nigerians Under Poverty Line Rise To 104m — World Bank

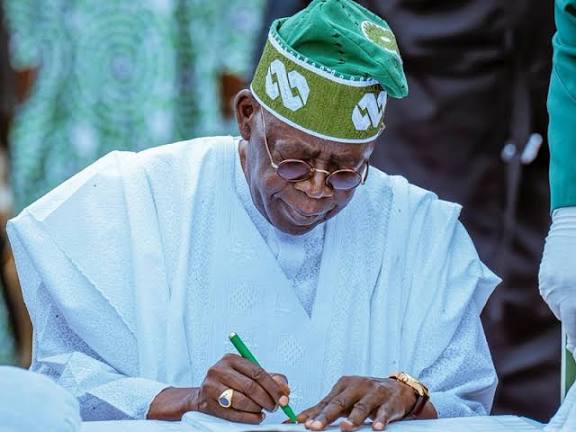

Economic Reforms: Nigerians Under Poverty Line Rise To 104m — World Bank

Nigeria’s poverty level has taken a notch higher, at the backdrop of the recent economic and fiscal reforms, World Bank report reveals.

A World Bank report has indicated that Nigeria’s poverty level has taken a notch higher, at the backdrop of the recent economic and fiscal reforms.

The key reforms include the removal of petrol subsidy and the foreign exchange market rate restructuring.

The bank, however, commended the Federal Government for what it considered ‘bold reforms’ necessary to rescue Nigeria from fiscal cliff, describing the current pains as temporary.

But it also said the policies have created intense pressures on cost of living, which have pushed more Nigerians into hardship, with 104 million now living below the poverty line.

The World Bank report also indicated that the number of poor people in Nigeria had grown from 95 million in 2021 to 100 million in 2022, while the Nigerian Bureau of Statistics, NBS, indicated that the figure was 82.9 million in 2019 and 85.2 million in 2020.

In its World Bank Nigeria Development Update, NDP, entitled ‘Turning the Corner: Time to Move From Reforms to Results’, the bank stresses the need to continue with the reform momentum to complete the reforms and to address the costs of the reforms.

It further stated: ‘‘Inflation remains at record high levels for Nigeria, 27.3 per cent Year-on-Year, YoY, in October 2023, partly driven by the one-off price impacts of the removal of the gasoline subsidy.

‘‘The impact of this is especially hard on poor and vulnerable citizens. The FX market has remained volatile and in a period of continuing adjustment to the new policy approach, with significant fluctuations in the exchange rate in both the official and the parallel markets. Revenue gains from the FX reform are visible.

‘‘However, there is a need for more clarity on oil revenues, especially the financial gains of Nigeria National Petroleum Corporation Limited, NNPCL, from the subsidy removal, the subsidy arrears that are still being deducted, and the impact of this on Federation revenues.”

In his appraisal of the country’s reforms, Shubham Chaudhuri, World Bank Country Director for Nigeria, stated: “The petrol subsidy and FX management reforms are critical steps in the right direction towards improving Nigeria’s economic outlook. Now is the time to truly turn the corner by ensuring coordinated fiscal and monetary policy actions in the short to medium term.

“Continued reform implementation can ensure that Nigeria benefits from the difficult adjustments underway. This includes ensuring that improved oil revenues following the sharply increased PMS price accrue to the Federation.

‘‘In the medium-term, the economy will then begin to benefit from increasing fiscal space for development spending, including on power and transport infrastructure, as well as on human capital.”

He further said that between N300 billion –N400 billion was expended on fuel subsidy monthly, before the subsidy removal and that the expectation was that the NNPCL should have been paying such amount to the Federation Account, but which has not been the case.