PAG Felicitates Muslims on Commencement of Ramadan Fast

February 18, 2026TOP TEN MUSLIM UNIVERSITIES IN AFRICA

February 14, 2026ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

February 10, 20261m Applicants Seek N1.3tr Consumer Credit Loan

1m Applicants Seek N1.3tr Consumer Credit Loan

More than one million applicants have made a cumulative N1.3trillion loan request from Nigerian Consumer Credit Corporation (CreditCorp).

They are among those eyeing participation in the consumer credit scheme of the Federal Government due to go into operation very soon.

No fewer than two million people are expected to benefit from the scheme by the end of next year.

A survey by the agency has identified 80 million Nigerians as qualified to participate in the programme.

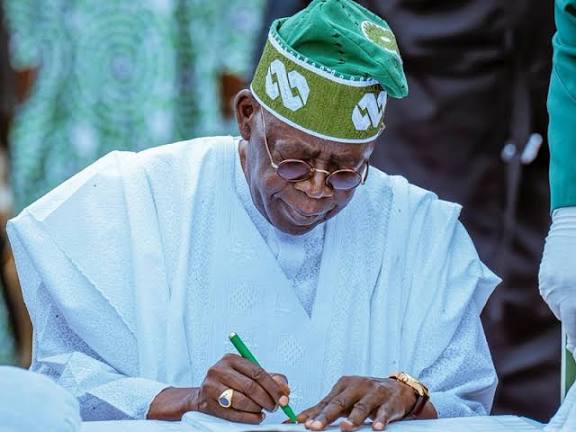

The scheme, a key campaign promise of President Bola Ahmed Tinubu, is programmed to enable Nigerians have access to soft loans to acquire properties that will make life easy for them without paying a lump sum.

A report by CreditCorp survey said: “In one week, over 1 million Nigerians submitted Expressions of Interest (EOI) to CREDICORP for consumer credit.’’

The report added that the ‘’EOI process also served as an organic nationwide survey to understand Nigerians’ personal economics and credit needs.”

The findings, which cover 36 states and the Federal Capital Territory (FCT), and about 723 local government areas out of the 774, paint a picture of a Nigerian populace hungry for access to credit.

CREDICORP said it received 1,149,805 submissions, with an average request amount of N1,115,088, saying that there appears to be a strong gender bias, with men accounting for 74 percent of the total submissions.

It nevertheless noted that subsequent rounds may uncover a more balanced picture.

CREDICORP said respondents’ average age is 33.5 years, with the 26-40 age group making up the larger share at 663,356 submissions.

The demand for consumer credit spans a diverse range of needs, with the top categories being small business loans, representing 18 percent, home purchases, 15 percent, vehicle acquisitions 10 percent, and personal/household expenses 16 percent.

Interestingly, the need for credit to fund school fees and investments also emerged as quite significant, averaging 16 percent and six percent respectively.

While the credit needs do not vary widely across gender and age groups, there were some notable trends, CREDICORP stated. It said women exhibit a slightly higher demand for household expenses, while men tend to prioritize home and vehicle purchases. As expected, the younger demographic segment, particularly students, has a strong need for credit to cover school fees.

It said within the occupational groups, civil servants stood out with a particularly strong demand for home purchases, while students account for over 58 percent of the credit requests for school fees, adding that entrepreneurs and skilled tradespeople, on the other hand, show a robust appetite for discretionary business-related credit.

CREDICORP put the average monthly income of the respondents at N223,647.92, suggesting that the credit demand was not solely driven by low-income individuals, but rather, by a broad-based need for access to affordable financing options.

Chief Executive Officer of CreditCorp, Uzoma Nwagba, told The Nation that the agency was on the last lap of planning for the take-off of the programme.

The goal is to make it possible for economically active Nigerians to have access to funding on credit for items that could make life comfortable for them, without having to pay upfront.

Nwagba said: “With consumer credit facility, if you have a modest income, you should be able to have access to a vehicle, solar panel, cell phone, laptop, education, house, and other things that improve the quality of your life, and you can pay for it over a prolonged period.”

The CreditCorp, established by the government, is to strengthen the country’s credit infrastructure and provide financial guarantees to institutions that have traditionally been hesitant to lend due to concerns about potential losses.

END.