PAG Felicitates Muslims on Commencement of Ramadan Fast

February 18, 2026TOP TEN MUSLIM UNIVERSITIES IN AFRICA

February 14, 2026ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

February 10, 2026Otedola urges CBN to raise banks’ capital to ₦1 trillion after meeting ₦500bn requirement

Otedola urges CBN to raise banks’ capital to ₦1 trillion after meeting ₦500bn requirement

Billionaire investor and Chairman of First HoldCo Plc, Femi Otedola, has requested taht the Apex Bamk, The Central Bank of Nigeria (CBN) to further strengthen the banking system by raising the minimum capital requirement for international banks to at least ₦1 trillion.

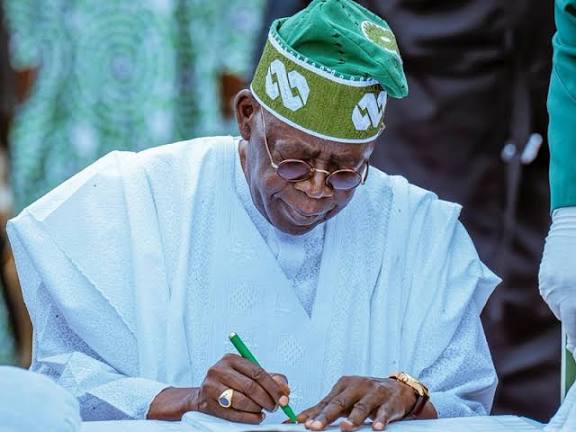

Mr Otedola made the call on Friday in a statement in which he commended President Bola Tinubu and CBN Governor, Yemi Cardoso, for what he described as bold and disciplined economic reforms that are beginning to yield tangible results.

His comments came as FirstBank of Nigeria Limited, the commercial banking subsidiary of First HoldCo Plc, confirmed that it has met the ₦500 billion minimum capital base set by the CBN for banks holding international licences under the ongoing banking sector recapitalisation programme.

According to Mr Otedola, Nigeria’s ambition to build a $1 trillion economy cannot be achieved with weakly capitalised financial institutions.

“From where I stand, and with the benefit of many years in Nigeria’s business landscape, I believe it is time to raise the minimum capital requirement for international banking licences from ₦500 billion to at least ₦1 trillion,” he said. “A modern economy aiming for the $1 trillion mark cannot rely on weakly capitalised banks.”

He argued that stronger capital buffers would improve governance, expand ownership structures and curb the long-standing problem of banks being run as “personal estates”.