Africa Richest Man, Aliko Dangote made over 700million Dollars From Selling Cement

March 2, 2026How Nigeria External Reserves Rose To $ 50.25 billion

February 26, 2026ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

The Nigeria economy has the largest market in Africa, with conglomerates like Dangote, MTN, Airtel, and BUA, the mega banks generating trillions as revenue. Yet the Gross Dostic Product (GDP) in dollars is still in position 3 in Africa. This writer looked at these indices and wondered why a market that generates that much revenue with the largest consumers in Africa won’t reach the trillion dollars cap

According to bloomberg, Nigeria GDP is 222.3 dollars. In the year 2025, it was 181.3 billion dollars, as it was published by Statista. In 2015. Nigeria GDP was 453 billion dollars. And it was the first in Africa. However, when the dollar to Naira exchange rate was around 150Naira to 1 dollar. From 2015, the economy started declining as a result of disparity in exchange rates. Analysis from data got from a cursory look reveals that the Nigeria market is also the largest market in Africa, followed by South Africa. This is because of the richest black man in Africa, Aliko Dangote, fostered by Nigeria mega companies.

According to IMF, As of early 2026, South Africa holds its position as Africa’s largest economy with a projected nominal GDP of approximately $426.38billion. The economy is experiencing modest growth, estimated at 1.3% for 2025 and 1.4% for 2026. Key drivers include the mining, trade, and financial sectors, with significant wealth concentration, making it a major financial hub on the continent.

According to Statista, for some African countries, the oil industry represents an enormous source of income. In Nigeria, oil generates over five per cent of the country’s GDP in the third quarter of 2023. However, economies such as the Libyan, Algerian, or Angolan are even much more dependent on the oil sector. In Libya, for instance, oil rents account for over 40 per cent of the GDP. Indeed, Libya is one of the economies most dependent on oil worldwide. Similarly, oil represents some of Africa’s largest economies, a substantial source of export value.

The largest contributor to the Nigeria economy is the service sector, according to Nigeria Bureau Of statistics, NBS The National Bureau of Statistics (NBS) announced on Monday that Nigeria’s gross domestic product (GDP) grew by 3.98 percent (year-on-year) in real terms in the third quarter of 2025.

The services sector continued to dominate, representing 53.02 per cent of GDP. Trade activity contributed 16.42 per cent, reflecting sustained household consumption and retail spending across the country. Real estate also proved resilient, accounting for 13.36 percent of output.

The non oil sector grew year by year in Nigeria, and add substantial growth to Nigeria Economy, however the impact on the market on the world standard does not complement th7e GDP growth in Naira. Analysing Data from NBS, the amount of money in curvulation grew by trillions in Naira. However, the economy on tbe global stage still remains in the struggling state in billions of dollars

This is because the change rate became abysmal as the year grew.

According to Pound Sterling Live, the dollar to Naira exchange rate in December 2015 was 199naira per dollar according to a Facebook post, in 2016 $1 = N300-N320 (N310-N370 Black Market Rate)

2017 $1 = N360

2022. = N610

Presebt day, exchange rate for US dollar to Nigerian nairas is currently 1425.82 today, reflecting a -0.588% change since yesterday. Over the past week, the value of US dollar has remained relatively stable, with a -1.068% decrease compared to its value 7 days ago.

During the past week, the exchange rate of US dollar to Nigerian nairas has fluctuated between a high of 1448.71 on 02-02-2026 and a low of 1423.37 on 05-02-2026. The largest 24-hour price movement occurred on 04-02-2026, with a -0.859% decrease in value.

The Nigeria stock exchange has gone through a lot of numbers during this administration.

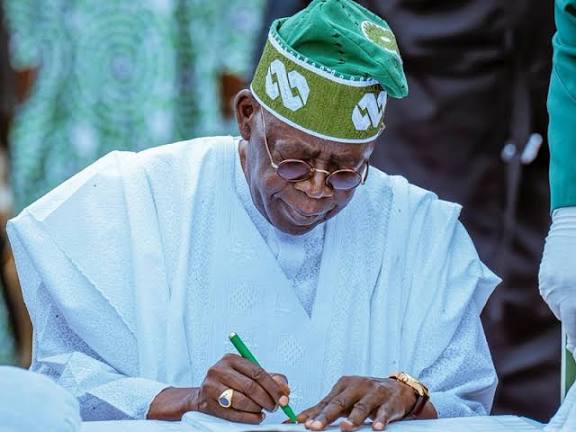

According to the state house, the Nigerian Exchange (NGX) has experienced a historic, record-breaking boom under President Bola Tinubu, crossing the ₦100 trillion market capitalization mark in early 2026. Driven by key reforms like forex unification and subsidy removal, the All-Share Index (ASI) saw over 136% growth within 26 months, significantly outperforming previous administrations and many global market, while the South Africa stock market, anchored by the Johannesburg Stock Exchange (JSE), experienced a stellar performance in 2025 and early 2026, with the FTSE/JSE All-Share Index hitting record highs above 120,000 points. Driven by a surging resource sector—particularly gold miners—and a strengthened Rand, the market saw one of its best performances since 2009, with equities gaining over 36% in the 12 months leading to January 2026.

1 US Dollar is equivalent to approximately 15.91 South African Rand, reflecting a -0.434% change since yesterday

The Nigeria Naira is on 1436 naira per dollar on the international market. The continent largest market is the Nigeria’s market. The onlybreason why South Africa economy can boast of tbe largest GDP in Africa is because of their exchange rate