EXCLUSIVE: Why Tinubu, staggered, tripped in Ankara

January 28, 2026PAG Calls for Active Voter Participation Ahead of 2027 Elections

January 25, 2026CBN’ll Retain High Interest Rates To Tame Inflation — Cardoso

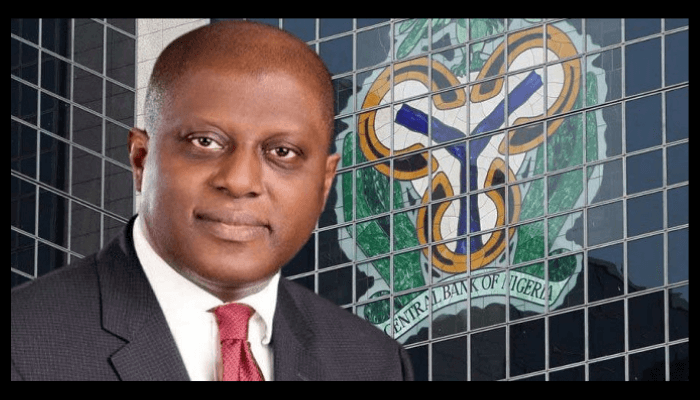

CBN’ll Retain High Interest Rates To Tame Inflation — Cardoso

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has hinted that the apex bank will keep interest rates high until inflation subsides by implementing orthodox policies.Inflation in Nigeria remains stubbornly high at 33.2 per cent, the highest in three decades, while food inflation is higher still at 40 per cent.

Cardoso, in an interview with the Financial Times, said that the Monetary Policy Committee (MPC), which he chairs, would do whatever is necessary to keep the soaring inflation in check.

“There is every indication that the MPC would do whatever is necessary. They will continue to do what has to be done to ensure that inflation comes down,” Cardoso said, ahead of the committee’s meeting on May 20 and 21.

Cardoso’s stance is in sharp contrast with his predecessor Godwin Emefiele, who oversaw an inflation crisis in Nigeria as the central bank regularly printed money to fund government deficits beyond the 5 per cent limit permitted by law.

He stated: “Let’s face it: for a long period, the CBN did not embrace orthodox monetary policies. We want to go back to using an orthodox method, and it will take us to where we want to go. The apex bank has been reoriented to focus on price and monetary stability.”

Recall that the monetary policy rate was hiked by 400 and 200 basis points in February and March respectively, which lifted the key lending rate to 24.75 per cent.

Speaking on the fluctuating value of the naira against the US dollar, Cardoso said the situation had now stabilised.

“Investors had previously tended to head for the window in response to currency fluctuations. But now, there had been a fundamental shift. They’re getting more comfortable with the market,” he stated.

Markets have generally welcomed the CBN’s stance under Cardoso, but the policies do not receive universal domestic support, with businesses complaining about the high cost of credit even as foreign portfolio investors have gradually returned to the country.

Razia Khan, Chief Economist at Standard Chartered Bank, said: “The return to orthodoxy has been very much endorsed by investors. While Nigeria is not seeking an IMF programme it is implementing the kind of policies that would be endorsed by the IMF.”

Dumebi Oluwole, Senior Economist at data firm Stears, said: “The central bank is on the mark with what needs to be done. But we have to remember that Nigeria’s inflation is a lot more structural. Issues like insecurity are affecting our ability to produce food and that is inducing food inflation.”

Also reacting, David Adonri, Vice Chairman, Highcap Securities, said: “High-interest rate is a bad omen for the economy. It escalates the cost of production and the cost of consumer credit. If supply-side measures are not concomitantly run, it can cause a vicious cycle of galloping inflation. “Consequently, monetary and fiscal policies should work together to start addressing the supply gap that will rein in inflation and reduce the interest rate.”

However, Cardoso said he hoped that high rates would not “linger” for too long and act as a disincentive to investment and production. He said that raising rates had been essential.

“Hiking interest rates has had a dampening effect on the foreign exchange market, so that has begun to moderate. It’s not a zero-sum game. You lose on one side, you get on the other,” he added.

Cardoso conceded that inflation was higher than he had hoped, blaming “distortions” mainly because of high food prices.

“That is something that is not directly within our control,” he added. Also speaking, Victor Chiazor, Head, of Research at FSL Securities, said: “The CBN governors take on the high-interest rate is not unexpected given the level of inflation. However, the question is whether the apex bank will continue to tighten or hold its policy parameters until it sees a slowdown in inflation figures. “Given that real return is still negative and inflation remains elevated, it will not be appropriate for the CBN to become dovish on its monetary decisions as that will further increase liquidity in the system and spur inflation further.”

END.