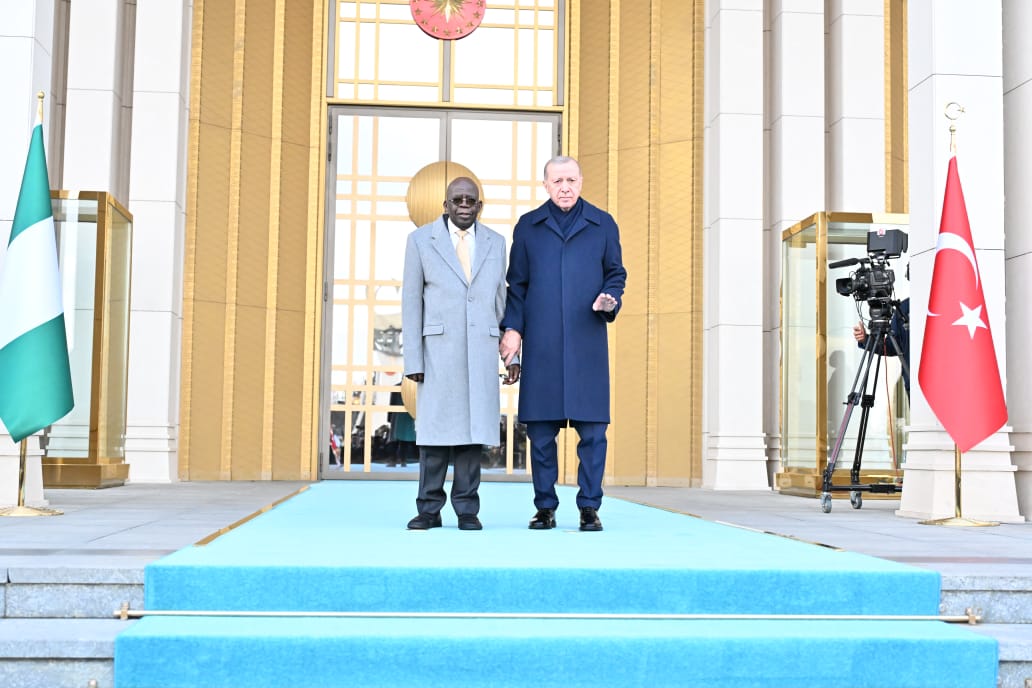

EXCLUSIVE: Why Tinubu, staggered, tripped in Ankara

January 28, 2026PAG Calls for Active Voter Participation Ahead of 2027 Elections

January 25, 2026Petroleum Charge Not New, Only Harmonised – Finance Minister

Petroleum Charge Not New, Only Harmonised – Finance Minister

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has dismissed reports that the recently signed Tax Administration Act 2025 introduces a new 5% fuel surcharge, clarifying that the levy is not new but only harmonised under the law.

Speaking at a press conference in Abuja on Tuesday, Edun said the inclusion of the surcharge in the Act was part of efforts to consolidate and streamline existing tax laws for clarity and ease of compliance.

“It is important to make this distinction. The inclusion of the surcharge in the 2025 Nigeria Tax Administration Act does not mean an automatic introduction of a new tax. It doesn’t mean fresh taxation automatically,” the minister said.

The surcharge, which recently drew criticism from labour unions and civil society organisations, was originally created to fund road maintenance, with 40% of proceeds allocated to the Federal Roads Maintenance Agency (FERMA) and 60% to state-level equivalents.

Concerns grew after the levy was referenced in the consolidated Act, sparking fears of additional burdens on fuel costs beginning in 2026.

Edun explained that the new law will only take effect from January 1, 2026, and even then, implementation would require a commencement order issued by the finance minister and published in an official gazette.

“There is a whole formal process involved, and as of today, no order has been issued, none is being prepared, and there is no plan. There is no immediate plan to implement any surcharge,” he said.

The minister further defended the government’s broader tax reform efforts, describing them as a long-overdue overhaul of Nigeria’s fragmented tax system.

He said the Tax Administration Act is one of four legislative instruments recently passed to improve transparency, simplify compliance for individuals and businesses, and modernise revenue collection.