PAG Felicitates Muslims on Commencement of Ramadan Fast

February 18, 2026TOP TEN MUSLIM UNIVERSITIES IN AFRICA

February 14, 2026ANALYSIS: Why Nigeria GDP is not the best in Africa Despite having the largest market

February 10, 2026Student Loan: A springboard for indigent students — AEFUNAI researcher

Student Loan: A springboard for indigent students — AEFUNAI researcher

Temidayo Olagunju, a lecturer and researcher at the Department of Biology, Alex Ekwueme Federal University, Ebonyi State, Nigeria, has commended the federal government over the enactment of the student loan law.

The lecturer gave his commendation in an interview with an i-News Nigeria correspondent.

The lecturer maintained that if well managed, it will be beneficial to students in higher institutions.

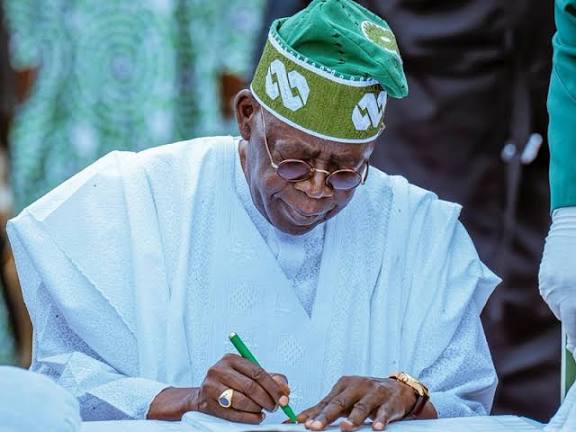

“Well, when I read in the news that the student loan bill has been signed into law, both the positive [side] and potential challenges that may be associated with the bill if not properly implemented or managed ran through my mind. However, I must say it’s a welcome development and kudos to the President of the Federal Republic of Nigeria,” Olagunju told our correspondent.

He added, “This is however not a new development in the global education sector. In fact, some African countries have a similar policy. Summarily, I feel that it may be a springboard for indigent students in higher institutions to achieve their academic dreams.”

Regarding the potential consequences of the bill, Olagunju remarked that the bill will greatly impact the education sector and the students in particular.

“First, it will enhance access to education and gives hope to students from poor backgrounds of achieving their desired academic feat. Second, it will foster equality in education as children of the firewood seller will be able to achieve academic qualifications that children of the billionaire can achieve in the country. Third, students who engage in certain acts or perpetrate vices such as prostitution to pay their tuition will have alternative means and therefore desist from such ignoble acts. Finally, pressure on financially incapable parents who want their children to earn higher education qualifications will be reduced as the children can take up loans,” he said.

He continued, “[The] university system will be impinged by the bill, no doubt. Truancy and absenteeism will be reduced. Many students skip classes to go for menial jobs to be able to raise money for their tuition. In many cases, this affects their academic performance. Hence, the bill will enhance students’ academic performance. Also, the bill would have a retrogressive chain effect on cultism in higher institutions of learning. Many students who are in secret societies today were promised financial support, particularly for their education. However, with this bill, the students will not have any need to taking such a decision since their education can be earned despite their financial incapacitation. In addition, the bill will enhance the percentage of the excellent graduating class of students.”

He explained further, “Yearly, many of the bright students who are offered admissions are unable to proceed due to financial constraints. With the bill, these potential high-performing students will be able to register for their intended programmes and then grade with first-class or second-class upper division, thereby enhancing the percentage of graduating students with excellent grades. Finally, as it is known in Nigerian academic institutions, the best brains are usually retained if they wish to become a lecturer.”

He, however, stated that “In the instances where these talents are not able to take up the admissions in the first place due to lack of funds, how will the future of the education sector be guaranteed? So, the bill will support the sustainability of developing talented academia.”

He also observed certain issues associated with the student loan law “which calls for caution in feeling relieved by all stakeholders particularly the beneficiaries — the students and the prospective students”.

Olagunju observed that the strict eligibility criteria requesting the provision of a guarantor having certain standings might thwart the process of obtaining the loan.

According to the researcher, this may be unachievable for many indigent students.

“Repayment issues and legal enormity for defaulters are also parts of the hiccups regarding the bill. Aside from the aforementioned, political will and implementation strategy have always been serious threats to any good social bill in Nigeria. What legal plans are available so that funds for the student loan are not diverted? If an education bank is established, how are its activities planned to be monitored for efficiency of loan disbursement?” he stated.

“These are part of the questions that must be critically analysed and answered,” he concluded.