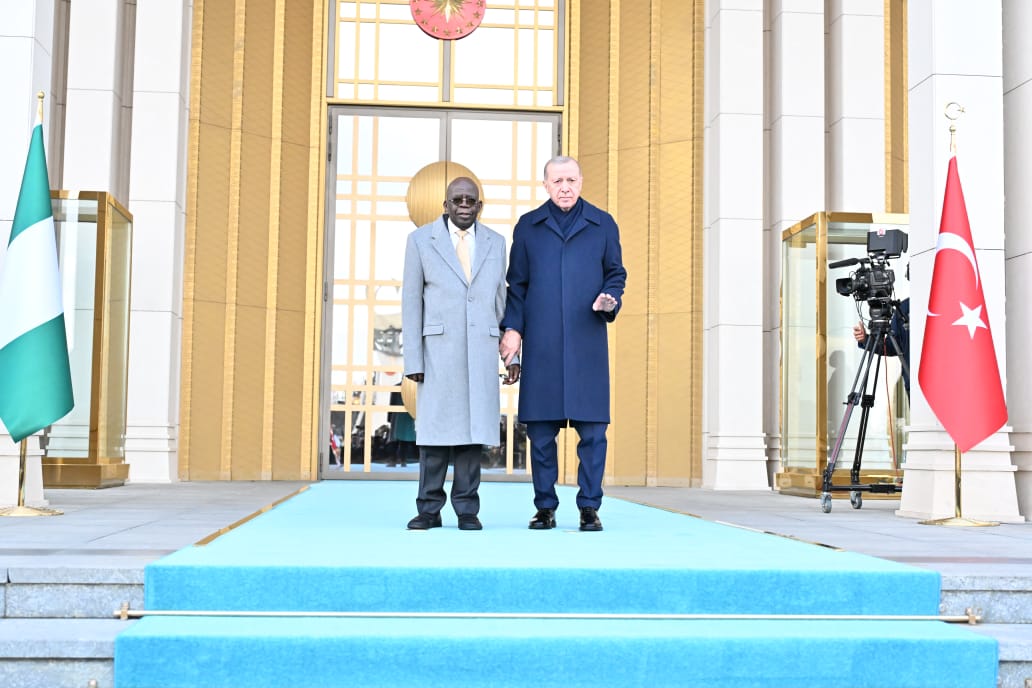

EXCLUSIVE: Why Tinubu, staggered, tripped in Ankara

January 28, 2026PAG Calls for Active Voter Participation Ahead of 2027 Elections

January 25, 2026Farmers Smile As Cocoa Hits $9,010.59 Per Tonne

Farmers Smile As Cocoa Hits $9,010.59 Per Tonne

Cocoa farmers may have been smiling to the bank as the produce price hit an all-time high of $9,010.59 per tonne at the Newyork Commodities Exchange.

Over the past year, the price per tonne of cocoa has tripled, skyrocketing from $2,000 to over $6,000 in the regular markets.

Nigerian cocoa farmers and exporters are reaping big as global cocoa prices hit record high, thanks to the steep naira devaluation that has resulted in a sharp increase in income from the export of the beans.

Agribusiness & Youth Empowerment Coordinator, Community of Agricultural Stakeholders of Nigeria (CASON), Sotonye Anga noted that it was the best time in the industry as cocoa price reached unprecedented heights, with economists projecting no downward trend through the year.

The spiralling price increase follows unfavourable weather conditions causing significant impact on cocoa production in Nigeria, Ghana and Ivory Coast.

Anga was delighted that the surge in pricing, though usually short lived, was having a ripple effect on the industry, with chocolate makers adjusting their operations to stay afloat.

Chocolate manufacturers, as a result of rising primary ingredient costs, are bracing for a potential demand slowdown.

Ingredients supplier Henley Bridge has reported that cocoa price increases of 15-20 per cent for the first half of the year are expected to continue for the remainder of the year.

Anga was of the opinion that industry needs higher prices to encourage farmers to invest in the business. Cocoa is a key ingredient in making chocolate. Right now, the farm-gate price is between N6.5million and N 7 million.

Encouraged by this, some farmers are mopping up the beans from neighbouring West African countries to sell to exporters.

For Anga, the naira devaluation and surge in global prices owing to a shortfall from top producers is benefitting cocoa farmers greatly. Nigeria, the world’s fourth-largest cocoa producer and supplier, saw the value of its global supply decline by 3.4 per cent to 280,000 metric tonnes in the 2022–2023 season, according to the International Cocoa Organisation’s latest data on global production (ICCO).

Last year, Cocoa futures prices surged more than $1,000 or nearly 40 per cent since the start of the year to hit an all-time high of $5,874 per metric tonne as bad weather conditions hammer crop yields in West Africa, home to three quarters of the world’s production.

In Ondo State, graded cocoa, certified fit for export, traded as N 2.5 million a metric tonne, while in Cross River State, the second-largest cocoa producer, cocoa fetched between N2.4 million and N2.5 million a tonne.

While cocoa is selling very high in London and in New York, the President, Federation of Agriculture Association of Nigeria (FACAN), Dr Victor Iyama, says local cocoa farmers are not smiling to the bank because it has not impacted on their profits. On the average, he said growers receive about six per cent of the price that consumers in rich countries pay for chocolate. Iyama said farmers receive a fixed price from agents of chocolate manufacturers at the season. The price offered by agents of chocolate manufacturers, he said, limits their ability to make profit when prices go up. While the profits of multinational chocolate companies have increased, he said cocoa farmers receive only a part of the world market price for beans. According to him, it is the big companies in chocolate manufacturing that are making high profits. He noted that it was time individual cocoa producing countries began to set prices for the produce they export.

To this end, he indicated that operators in the sector are rallying to see the emergence of Africa Cocoa Exchange to revolutionize cocoa marketing in Africa. According to him, the exchange will bring positive impact to achieving a sustainable world cocoa economy. The global cocoa industry is worth $200 billion annually and West Africa, which produces 75 percent of the world’s cocoa supply, makes less than $10 billion annually from it. The Managing director of the Nigerian Export-Import Bank (NEXIM), Abba Bello, represented by Tayo Omidiji, general manager/head of strategy and corporate communications, NEXIM Bank recently at a press briefing to announce the International Cocoa and Chocolate Forum (ICCF) 2024 which was held in Abuja in January this year added that there was a need for all hands to be on deck amongst all stakeholders, including policymakers, researchers, organised private sector and financial institutions, to discuss strategies to crowd in investments and address all the other issues militating against the huge potentials in the Nigerian Cocoa industry.“It is instructive to note that the cocoa industry (including beans, cake, chocolate, etc.) is worth $200 billion annually, out of which the entire West African producing region (made up of Cote d’Ivoire, Ghana, Cameroon, and Nigeria), which accounts for about 70-75 percent of the global output, earns only $10 billion.

END.