How Saud Royalty Became The Wealthiest Family In The World

January 16, 2026Top Ten Wealthiest Muslims In The World

January 13, 2026BDCs’ Return To FX Market Causes Naira Appreciation Against Dollar– Gwadabe

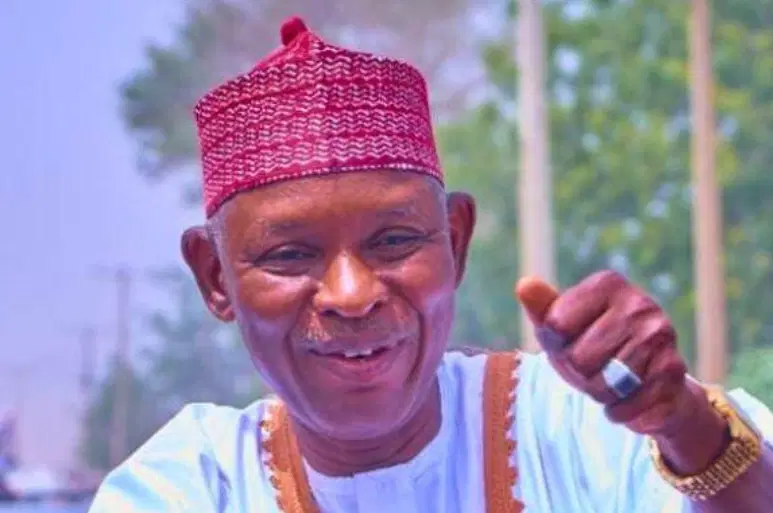

BDCs’ Return To FX Market Causes Naira Appreciation Against Dollar– Gwadabe

The President of the Association of Bureaux de Change Operators of Nigeria, ABCON, Aminu Gwadabe, says the Naira appreciated by N660 against the US dollar since the Governor of the Central Bank of Nigeria, Olayemi Cardoso, recalled BDC operators into the Foreign Exchange Market.

Gwadabe disclosed this to the Press in a statement at the weekend.

According to him, aside from monetary policy tightening that led to an increase in the exchange rate, more investment in government instruments and clearance of $7 billion forex backlog, the recall of the BDCs was also a significant move by the apex bank to boost dollar liquidity at the retail end of the forex market.

Gwadabe stressed that the Naira has appreciated from February’s low of N1,915 per USD to N1,255 per USD, representing N660 gains for the Naira, which is significant by all measures.

The ABCON president expressed gratitude to the Cardoso-led CBN and other related agencies for recognizing BDCs as the third leg of the foreign exchange market and an effective exchange rate transmission mechanism in forex management.

He said: “The reconsideration of the BDCs into the mainstream foreign exchange market has not only demystified illegal economic behaviours of hoarding, rent-seeking, round tripping and FX holding position, and led to the emergence of exchange rate convergence.”

He noted that the stability in the exchange rate has already started to impact the prices of goods and services positively.

“For instance, the price for international school fees has dropped by 15 per cent; the cost of medical tourism has reduced by 20 per cent, and airfares for local and international trips dipped by 25 per cent.

“The current developments in the foreign exchange market have started reigning in inflation as most necessities’ prices are relatively lower. On a more serious note, the positive impacts include also heightening the public’s confidence in the local currency as it eliminates currency substitution behaviour, which hitherto adds pressure on our local currency,” he stated.

He said, the prospects for forex earnings are promising, with foreign portfolio investments rising and over $1.5 billion inflows a few days after the Monetary Policy Committee raised the interest rate by 200 basis points.

He said increases in foreign exchange inflows into the economy through the CBN’s monetary instruments are helping to boost foreign reserve accretion and give the apex bank the necessary power to continue to defend the local currency.

END.