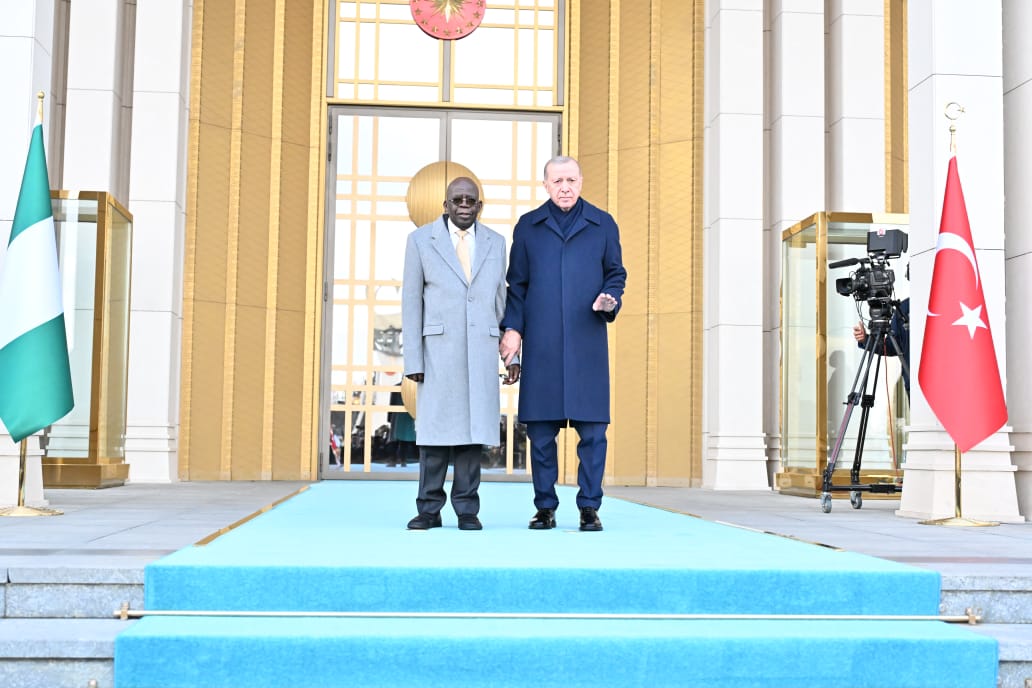

EXCLUSIVE: Why Tinubu, staggered, tripped in Ankara

January 28, 2026PAG Calls for Active Voter Participation Ahead of 2027 Elections

January 25, 2026Breaking: Naira Makes Strong Comeback Against Dollar In Parallel Market

Breaking: Naira Makes Strong Comeback Against Dollar In Parallel Market

The Nigerian Naira recorded a significant appreciation in the parallel market, strengthening to ₦1280/$ yesterday (Saturday) as gathered from currency traders.

This marked an impressive recovery from ₦1,400 to a dollar on Friday, reflecting a gain of 8.57 percent.

The surge comes after a period of volatility where the local currency had plummeted midweek, losing a third of its value just two weeks after rallying to below ₦1,000 against the dollar.

The sharp decline to ₦1,400 was attributed to fresh demand pressures, raising concerns among investors and the public regarding the effectiveness of the Central Bank of Nigeria’s (CBN) interventions in the forex market.

Recall that CBN had in the beginning of the week, executed a strategic sale of $15.83 million to 1,583 Bureau De Change (BDC) operators at a rate of ₦1,021/$1.

This move was part of a broader effort by the apex bank to enhance foreign currency accessibility for qualified end-users and stabilize the foreign exchange market.

Currency traders noted that the recent depreciation of the Naira was largely driven by market dynamics, where the supply of dollars was insufficient to meet rising demand.

Despite these challenges, the Naira was traded between ₦1,280 and ₦1,300 per dollar in the parallel market as of the latest reports.

Conversely, at the official foreign exchange window, the Naira continued its downward trajectory, closing at ₦1,339.23/$1 on Friday, according to data from FMDQ.

This represented a 2.24 percent depreciation compared to the ₦1,309.88/$1 rate reported the previous day.

The CBN’s recent initiatives seem to have made a positive impact, as evidenced by the Naira’s recovery from an early March rate of ₦1,617 per dollar to ₦1,072 per dollar on April 17.

Meanwhile, the Association of Bureaux De Change Operators of Nigeria (ABCON), has revealed plans for a unified retail end of the foreign currency market to tackle the recent Naira depreciation.

The president of the association, Aminu Gwadabe, disclosed this on Friday, noting that the move would tackle volatility and boost regulatory compliance within that market segment.

According to him, the association is implementing plans meant to unify operators from different cadres of the market, including the inauguration of state chapters for market coordination, integration and administering a united market structure.

END.