Business: Interest rate rises to 18.5% to tame inflation

The Central Bank of Nigeria (CBN) has announced an increase in the monetary policy rate from the previous 18% to 18.5%.

This adjustment marks the seventh consecutive rise since May 2022.

The Monetary Policy Rate (MPR) serves as the benchmark interest rate for the nation’s economy and reflects the rate at which the CBN lends funds to deposit money banks.

By raising the MPR, the CBN aims to influence borrowing costs, regulate liquidity, and encourage responsible lending practices.

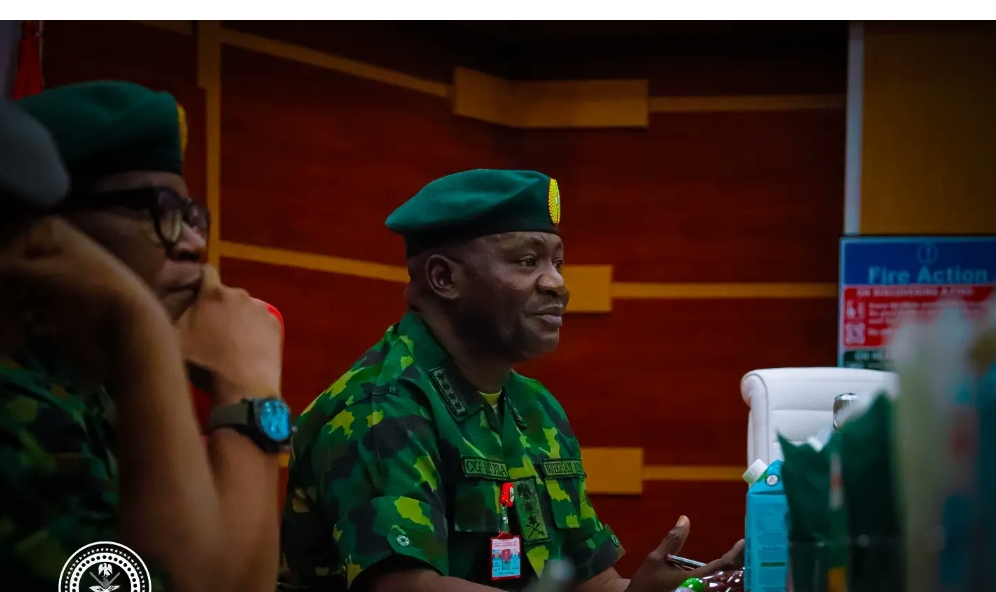

Governor Godwin Emefiele, speaking at the conclusion of the Monetary Policy Committee meeting in Abuja, expressed the bank’s determination to address the aggressive inflationary pressure that has persistently challenged the economy.

He highlighted that the decision to increase the rate was based on extensive research conducted by the CBN, revealing that the inflation situation would have been even more severe without the bank’s proactive measures to maintain a higher interest rate.

Emefiele emphasized that maintaining or loosening the rate would be counterproductive, as it could further exacerbate the inflationary pressure.

Furthermore, Governor Emefiele underscored the significance of addressing the country’s crude oil production levels. With current production at 1.1 million barrels per day, he emphasized that this figure poses a considerable risk to the economy.

He stressed the urgent need to ramp up production to meet the country’s OPEC-allotted quota of 1.8 million barrels per day