Submit Your Profile: IGP Tells Organisers of Nationwide Protest

July 26, 2024I have No Cabal, My Election Campaign Was Self-Sponsored-President Tinubu

July 26, 2024Coalition for Global Peace Condemns Bad Portrayal of Muslim Women Dress by Film Producer

July 25, 2024Nigerians express diverse reactions to Student Loan Law

Nigerians express diverse reactions to Student Loan Law

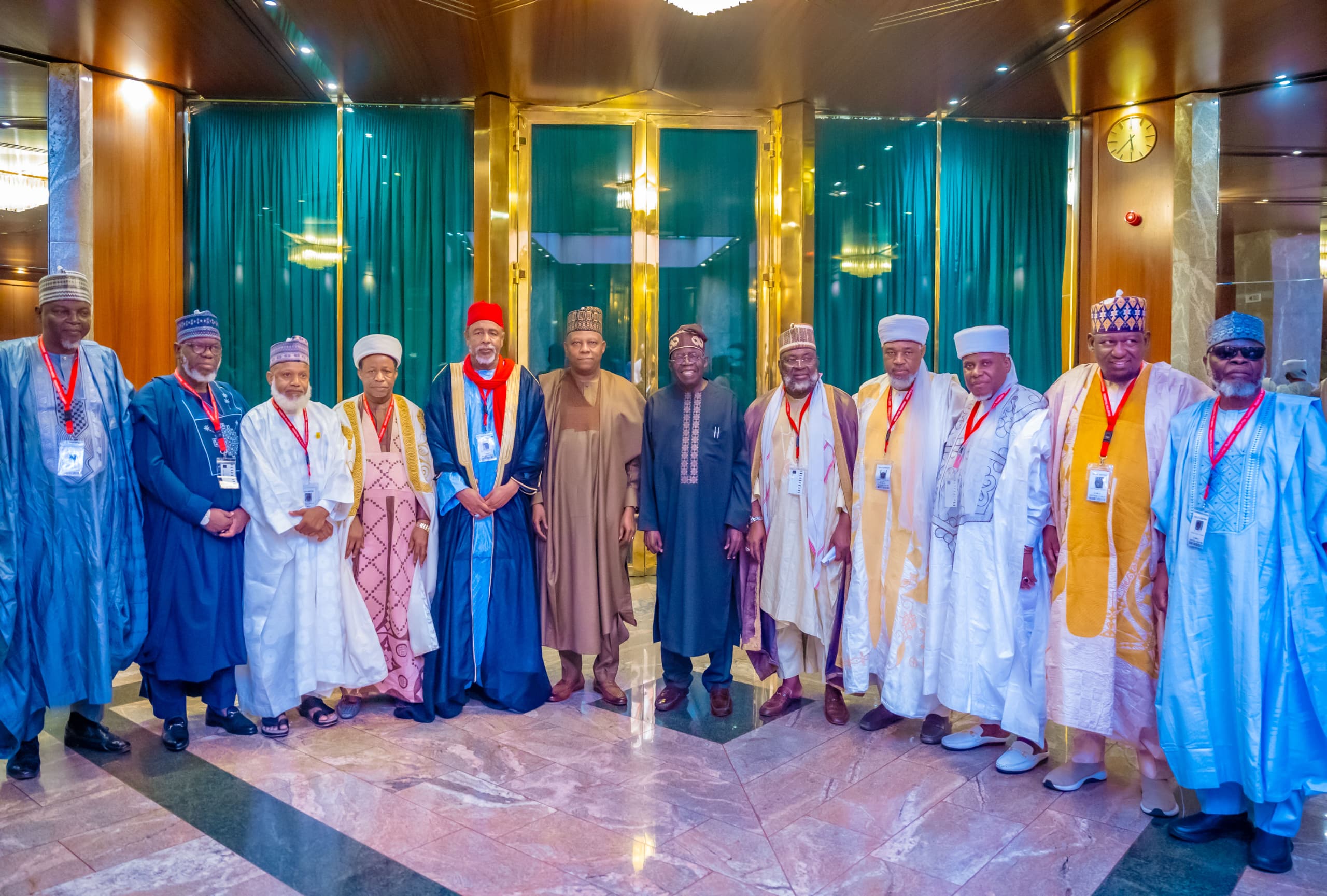

President Bola Tinubu has brought joy to numerous Nigerians, particularly students in higher institutions, by enacting the Student Loan Bill, a significant achievement.

This bill was signed into law on Monday, June 12, 2023, in commemoration of this year’s Democracy Day, and Nigerians perceive it as a generous gift from President Tinubu.

However, the new law has elicited diverse reactions. While some Nigerians appreciate it as a means to alleviate the financial burdens faced by parents of underprivileged students, others have criticized the conditions attached to loan collection and repayment.

The Origin of the Student Loans Bill In Nigeria

According to a report, the Student Loan Act can be traced back to the 1970s when the former head of state, Yakubu Gowon, introduced federal student loans with a repayment period of 20 years. Under this decree, students received funds for tuition, fees, and other approved expenses as determined by their schools.

The Nigerian Students Loans Board was established in 1972, providing loans totaling 46 million Naira between 1973 and 1991. These loans aimed to assist Nigerian students in financing their undergraduate or postgraduate studies, whether in Nigeria or abroad.

Who Sponsored the Newly-Enacted Bill?

The bill, which was successfully passed by the Legislative in May 2023, was sponsored by Femi Gbajabiamila, the former Speaker of the House of Representatives and the current Chief of Staff to President Tinubu.

The primary objective of the bill is reflected in its title: “An Act to facilitate convenient access to higher education for Nigerian citizens utilizing interest-free loans from the Nigerian Education Bank, as established by this legislation, to promote education for Nigerians and address related matters.”

According to a report, the loan source specified in the law recommends that 1% of revenue from the Nigeria Customs Service (NCS), Nigeria Immigration Service (NIS), and Federal Inland Revenue Service (FIRS), as well as 1% of profits from oil and minerals, contribute to the Nigerian Education Loan Fund. This fund is now managed by the Central Bank of Nigeria (CBN).

The loan is interest-free, which is widely appreciated, but certain criteria raise concerns.

According to the Act, the borrower’s family must have an annual income of no less than N500,000; and two guarantors are required: a civil servant with a minimum of 12 years in service and a lawyer with at least 10 years post-call experience.

Furthermore, the loans only cover tuition fees and are disbursed directly to the universities, excluding accommodation and living expenses. Private university students are also not eligible for these loans, which are specifically designated for universities, polytechnics, colleges of education, and vocational schools established by federal and state governments.

Challenges

Repayment presents a major challenge with this loan programme. As per the Act, Nigerians who acquire student loans are expected to commence repayment two years after completing the National Youth Service Corps (NYSC). The Act states that employers must deduct 10% of the borrower’s salary.

Defaulting on loan repayment carries severe consequences, including a prescribed two-year jail term, regardless of whether the borrower has secured employment or not.

Reactions from Nigerians

Following the enactment of the Student Loan Bill by the federal government, i-News Nigeria correspondent gathered the perspectives of various stakeholders, including parents, lecturers, and students, regarding this new bill.

Below are the reactions

The national president of the Academic Staff Union of Universities (ASUU), Emmanuel Osodeke, stated that the signing of the student loan bill into law by President Bola Tinubu is discriminatory.

Prof. Osodeke, in an interview with The Punch on Tuesday stated that ASUU is not impressed by the law enacted to support indigent students.

“The union will react soon but everyone knows our position on student loans because you will end up encumbering the children of the poor with loans and debt after graduating. This is discriminatory. If what I read online is correct, it said it is only for children whose parents earn at least N500,000 per annum. That means if your father earns more, you won’t benefit.”

Aside from ASUU, the National President of the Academic Staff Union of Polytechnics, Mr Anderson Ezeibe, is also not impressed by the development.

“I have not studied the bill and we don’t want to react on the surface. But I have seen one area that will not be practicable.

“It says that students should refund the money two years after NYSC. But what is the provision for someone who is not working after NYSC? And will they all get jobs immediately after NYSC?”

Nigerian human rights activist and the presidential candidate for the African Action Congress (AAC), Omoyele Sowore, wrote:

“Student Loans are never good for a society that needs to aggressively fund education. The US has more or less devoured its young and old educated population with student loans.

“What Nigerian youth need now is free quantitative education at all levels.

“Many US citizens today are victims of education loans whereas the US spends unconscionable amounts in fighting wars that benefit none of their citizens.

“Every student in our educational institutions at the higher levels should earn nothing less than N100k per semester as a study grant.

“Even the US has evolved past this stage and is now seeking ways to massively forgo student loans.

“I’ve spoken extensively about loans because I am still owing student loan sharks 20 years after graduating from Columbia University in New York.

“Nothing good will come out of students’ loans.”

A lecturer at the University of Ibadan, Prof. Abiodun A. Olapade, wrote:

“On the surface, it sounds good but implementation looks cumbersome. Is there going to be automatic employment for the beneficiaries or how will they be able to pay back the loan?

“The bill is dead on arrival because of logistic problems associated with repayment of the loan. This is not the first time the idea is introduced in the country. What happened to the previous attempt?

A student at the Federal University of Agriculture Abeokuta, Abdulazeez Idris, reacted:

“It is a good idea, I think students who want to pursue academic careers have the opportunities to go for it, making their dreams and goals get fulfilled.

“It would solve most of their financial problems.”

A lawyer at Oloruntola and Co, Ado-Ekiti, Korede Abdullah, wrote:

“The passage of the bill has given me the hope that if a leader has the political will and determination, what sounds utopian and impracticable to cynics will be carried out seamlessly.

“So I feel really happy that this bill has seen the light of the day, the first of its kind in Nigeria, and arguably, in Africa.

“The consequence is that, the Act will enable indigent students, irrespective of religious background[s] and sex, to access federal government loans to fund their educational pursuit or career. It will eventually fill their financial gaps and relieve their parents and sponsors of the financial burden considerably. It is an understatement to say that many families are undergoing economic downturns, so it is an answer to their prayers.

“I do not doubt that the student loan will impact the university system positively, in the sense that fear of finance, which is one of the students’ greatest challenges will be allayed. It’s a psychological boost for university students and the entire university system.

“Let us give the government the benefit of the doubt that the programme will be implemented to the letter. It’s too premature to express pessimistic views about it, much so that the programme has not kicked off.”

A teacher of economics and Head of the Business Unit at Landmark College, Ikorodu, Adeyoye Agbolade O, wrote:

“The passing of the bill marks the beginning of good things to come in the educational sector in Nigeria.

“If implemented, it will enable the poor to assess tertiary education in Nigeria.”

A Lagos-based Nigerian legal practitioner, Idowu Awopeju, wrote:

“It can’t make any difference. Anybody excited or feeling relieved about it, in my own opinion, is naively delusional.

“For clarity’s sake, I do not see how a welfarist policy or socialist agenda can bring about succour to the people with the current cost of governance.

“Pray, of what impact, so far so good, is the bicameral legislature to the people of Nigeria?

“Deal with the culture of reckless spending at the expense of the people first before talking about a welfarist intervention.”

A Lagos-based trader, Jimoh Bilikis, commended the president for the initiative.

“This is a great relief for Nigerian parents. I must commend President Tinubu. My observation is that the loan should be extended to cover beyond tuition.”

Temidayo Olagunju, a lecturer and a researcher at the Department of Biology, Alex Ekwueme Federal University, Ebonyi State, Nigeria, commented:

“Well, when I read in the news that the student loan bill had been signed into law, both the positive and potential challenges that may be associated with the bill if not properly implemented or managed ran through my mind.

“However, I must say it’s a welcome development and kudos to the president of the Federal Republic of Nigeria. This is however not a new development in the global education sector. In fact, some African countries have [a] similar policy.

“In addition, I must say that the bill will greatly impact the education sector and the students in particular. First, it will enhance access to education and gives hope to students from a poor background of achieving their desired academic feat. Second, it will foster equality in education as children of the firewood seller will be able to achieve academic qualifications that children of the billionaire can achieve in the country. Third, students who engage in certain acts or perpetrate vices such as prostitution to pay their tuition will have alternative means and therefore desist from such ignoble acts. Finally, pressure on financially incapable parents who want their children to earn higher education qualifications will be reduced as the children can take up loans.”

“Summarily, I feel that it may be a springboard for indigent students in the higher institutions to achieve their academic dreams.”

In his reaction, Qudus Ibrahim, the lead trainer at iteach Hub and the HOD Humanities Department, Atlantic Hall Educational Trust Council, stated:

The recently enacted legislation is a fulfilment of one of the campaign promises of the new president. With this, the president has walked his talk. He has demonstrated that he can be trusted in words and actions.

“I strongly feel that the legislation will help revitalise education in Nigeria and poverty will no longer be an excuse for illiteracy cum ignorance.

“I feel it is an upgraded version of the free education policy of the UPN of old, though, this is not free, but the burden of repayment is eased at least.

“Also, beyond students loan, the bill also seeks to establish an education bank. By so doing, employment options have opened up for bankers and other associated skilled hands. Thus, it is a policy that is directed at achieving a multi-dimensional purpose. Education on the one hand, employment on the other. The beauty of this bill is that it is interest-free.

“Therefore, students will not graduate into debt in motion occasioned by the double-digit interest rate. This will obviously improve the rate and period of repayment.

“As a responsible parent, one is driven by the constant need to pay school fees in the face of a meagre salary that may likely arrive with attending debts. This legislation will therefore relieve one of some financial burdens. It has a cushion effect, especially after the sudden removal of the subsidy. In fact, the only thing my child may need to get a higher education is my reputation as I do not need to pay immediately. Welcome to a Nigeria where students may end up paying their own school fees within two years of graduation.”

A student of Business Administration at the University of Lagos Grant Ikechukwu Nwani, reacted:

“The education bill is a wonderful initiative in my opinion and I am so pleased to be alive at a time like this. However, there is a need to put measures in place to guard against misappropriation of the said funds and ensure that the loan gets to students who need it.

“The measure should be devoid of nepotism, favouritism, or tribalism.

“Students will have one less headache. The thoughts of how to pay tuition fees will, at least be exterminated which gives well-meaning students the ability to focus on their studies better.

“My concerns about the practicality and effectiveness of this loan bill are the measures put in place to ensure the loans are fully repaid, checks and balances to curb the excesses of the entities in charge of giving these loans, the penalties to be paid if the entities in default on their duties.”

Idara Umosen, a seasoned educator and vice-principal (academics) at Bloombreed High School, Port Harcourt, also reacted to the bill:

“I think the government is trying to be creative and forward-thinking. However, I wonder if this is the best great way to start supporting education in Nigeria. I do not think we are ready or have the resources to implement it successfully. I would rather encourage the government to pass bills that affect primary/secondary school students. Nigeria has up to 10 million schoolchildren. We need to support them first then deal with the tertiary people.”

In summary, it is important for Nigerians to express their gratitude to President Tinubu for approving the bill. As per a widespread viewpoint, student loans aim to grant underprivileged students access to educational opportunities while alleviating financial burdens on their parents.

These loans will cover expenses such as tuition fees, books, supplies, and other educational costs. By doing so, students can dedicate themselves to their studies without being preoccupied with immediate financial constraints.